- The Market Research (Chapter 2 Summary)

This blog post is a summary of Chapter 2 of the Book Real Estate Investing – Market Analysis, Valuation Techniques and Risk Management by Benedetto Manganelli.

Part 1

Abstract in Plain English

A successful real estate investment does not begin with bricks, land, or financing. It begins with market research.

Unlike most industries, real estate offers almost infinite differentiation. No two properties are identical. Location, design, perception, timing, and user preferences all combine to make each investment unique. Because of this, research in real estate must go deeper, wider, and more carefully than in most other sectors of the economy.

This chapter explains:

- Why market research is essential

- What kind of data is required and where it comes from

- How research progresses from broad economic trends to a single property decision

2.1 Why Market Research Matters

At its core, investing in real estate is an act of confidence in future cash flows.

Investors expect returns from:

- Rental income during ownership

- Capital gains at resale

Both are future outcomes, and both depend on variables that are uncertain today. That uncertainty is exactly why market research exists.

Market research allows investors to:

- Estimate future demand and supply

- Understand how users will behave

- Calculate realistic returns rather than optimistic ones

Without research, investment decisions become speculation.

Research Supports Every Phase of Investment

Market research is not a one-time activity. It is used:

- Ex-ante: before investing, to decide whether the project makes sense

- In progress: during development or operation, to adapt to changing conditions

- Exit decisions: when deciding whether to sell, hold, or convert a property

For example:

- Should a building be leased short-term or long-term?

- Should large units be subdivided to attract more users?

- Should a residential property be converted to commercial use?

All these decisions rely on the same underlying variables: income levels, employment, consumption patterns, and user preferences.

Research Even Shapes Design

Market research influences architecture and construction choices.

It helps answer questions such as:

- Which amenities tenants actually value

- Which features increase rent and which only increase maintenance costs

- Whether comfort upgrades translate into higher income

In other words, research prevents overbuilding and under-designing at the same time.

Real Estate Is Not a Perfect Market

If real estate were a perfectly competitive market, research would be unnecessary. Prices would reflect all information, products would be standardized, and cost control alone would determine success.

But reality is the opposite:

- Every property is unique

- Location alone makes properties incomparable

- Perception matters as much as physical attributes

A building’s reputation, for instance, is not just about construction quality. It is shaped by collective perception, branding, and user experience. This reputation cannot be copied easily and becomes a competitive advantage if managed correctly.

2.2 Data Availability and Sources

Once the purpose of research is defined, the next challenge is data collection.

This is where real estate research often struggles.

Primary vs Secondary Data

Market data comes in two forms:

Primary data

- Collected directly by the analyst

- Includes surveys, interviews, direct observations

- More accurate and tailored

- More expensive and time-consuming

Secondary data

- Collected by others for different purposes

- Includes government statistics, reports, databases

- Cheaper and easily available

- Often outdated, aggregated, or unsuitable

In practice, analysts usually start with secondary data and then supplement it with primary research where gaps exist.

Prices vs Perceptions

Prices are the most objective data in real estate. They are real, observed outcomes and form the basis of valuation.

However:

- Prices are not always available

- Transactions may be infrequent

- Searching for prices can be costly and slow

In such cases, interviews are used to estimate willingness to pay. While cheaper and faster, interviews are less reliable due to:

- Strategic responses

- Interviewer bias

- Respondents saying what they think is expected

For this reason, observed prices are always preferable when available.

Not All Useful Information Is Numeric

Many critical inputs are descriptive rather than numerical:

- Tenant profiles

- Household composition

- Preferences for lease terms

- Reactions to hypothetical changes

These insights cannot be captured through prices alone and require qualitative research.

The Limits of Secondary Data

Secondary sources often:

- Aggregate small local markets into large regions

- Provide averages rather than actual transaction prices

- Mask differences between nearby properties

This creates a risk: using abundant but irrelevant data simply because it is available.

A city-wide average rent tells you very little about a specific street, building age, or micro-location.

2.3 How Market Research Develops

Market research progresses from general to specific.

At each step:

- Information becomes more detailed

- Costs increase

- Accuracy improves

The fundamental rule is simple:

Define the problem clearly before collecting data.

The Three Levels of Analysis

- Macro level

- National economic trends

- Inflation, interest rates, GDP growth

- Regional / metropolitan level

- Employment, population growth

- Infrastructure, regulation, incentives

- Local submarket level

- Competing properties

- Vacancy rates, rents, absorption

- Tenant perception

A property competes not with the entire city, but with a very small submarket defined by how users perceive substitutability.

From Broad Data to Property-Specific Forecasts

One effective approach moves through five stages:

- Collect general economic and demographic data

- Collect data specific to the property’s market segment

- Identify relationships between macro trends and local behavior

- Project future macro conditions

- Translate those projections into forecasts for the specific property

This process bridges the gap between national trends and a single investment decision.

Practical Research Sequence

A well-structured market study typically follows this order:

- Analyze national economic trends

- Study metropolitan economic and demographic conditions

- Define the exact market area where competition exists

- Forecast demand for the specific property type

- Analyze existing and future competition

- Estimate new supply entering the market

- Match property characteristics with tenant needs

The goal is not to predict the entire market, but to estimate how much of the submarket demand will realistically choose the property.

Final Outcome: The Market Research Report

All findings must be organized into a final report that:

- Supports investment decisions

- Feeds into financial modeling

- Reduces uncertainty

- Improves risk management

In real estate, returns are earned in the future, but mistakes are made in the present. Market research is the discipline that prevents those mistakes by replacing assumptions with evidence.

Part 2

Market Research in Real Estate: How Much Is Enough, and When It Matters

Real estate research is a bit like packing for a trip: overpack and you waste time and money; underpack and you land somewhere cold holding only sunglasses. The trick is knowing how uncertain the terrain is and how complex the asset is.

This post walks through a practical way to think about real estate market research: when to keep it lean, when to go deep, how to draw the “real” boundaries of a market, and which variables best predict whether your project will actually find users (and payers).

1) Reliability of Your Research Depends on Three Forces

The effectiveness of market research is shaped by three core factors:

- Stability of market conditions

- Complexity of the property

- Risk attitude of the investor

If the market is calm and the asset is straightforward, heavy research can be overkill. When uncertainty rises, the “minimum viable research” expands.

Stable market + simple property

When supply and demand feel like they’re in a steady rhythm, you can often focus on a small set of high-signal indicators such as:

- prevailing rent levels,

- vacancy rates,

- and simple value relationships like NOI (net operating income) vs market value.

If conditions suggest changes will be linear and predictable, ultra-refined models can become expensive decoration rather than useful decision tools.

Volatile market + changing conditions

When markets are hit by abrupt shifts (policy changes, migration flows, sudden construction booms), research needs to scale up in both quantity and quality. The job becomes forecasting how these forces bend the local market. If a neighborhood is shifting from residential to commercial, for example, you want to study the speed of change and how it may reshape future profitability and strategy.

2) Costs vs Benefits: The “Optimal Depth” of Research

Research has diminishing returns. Early research typically produces large clarity gains, but after a point, every extra layer of investigation costs more than it’s worth.

A useful mental model:

- Keep digging while the marginal benefit exceeds the marginal cost.

- Stop when added precision becomes expensive but doesn’t materially change decisions.

There is no perfectly objective “optimal” depth because you can’t directly measure “the value of information” with certainty. But you can treat it as a decision: “Will this extra work likely change what I choose to do?”

3) Define the Market Before You Analyze It

A market isn’t “the city.” It’s the real footprint of who will realistically use or buy your property.

A solid market definition starts by choosing geographic limits that match your objective:

- For a small residential project, the neighborhood may be enough.

- For a large shopping center, your market may need to be regional.

What shapes market boundaries?

The strongest drivers are:

- transfer time (how long it takes to reach the property),

- transfer cost (money plus the value of time).

For residential markets, “transfer” often means commuting to work, reaching services, and everyday convenience. But people don’t optimize only for distance. They also trade distance for quality of life: safety, aesthetics, environmental quality, social prestige, and comfort.

For commercial properties, the market area is commonly “where most customers come from,” and it generally shrinks as travel time rises.

Rules of thumb for commercial catchment areas (time-based):

- Supermarket district: 5–10 minutes

- Hypermarkets: 10–15 minutes

- Large shopping malls: 15–30 minutes

4) Market Potential: The Core Data You Actually Need

A market analysis should move from the general to the specific:

- start with the national economy (GDP, cost of money, demographics, employment, policy),

- then connect it to the local submarket.

This isn’t always easy because macro changes hit local markets with delays and uneven intensity. Still, for most real estate decisions, the local market is where the truth lives.

To build a usable “cognitive framework” of the market area, the key categories of information include:

Demographics and employment

- population size and growth,

- employment levels and stability,

- industry diversification (a one-industry town is a fragility machine).

Income and affordability

You want to know not just “how many people,” but:

- who can pay,

- how reliably they can pay,

- and whether they can qualify for ownership (or sustain rent).

Planning and regulation

Planning decisions can accelerate land-use transitions and heavily influence land rent and values. Even a great asset can get kneecapped by zoning constraints, infrastructure bottlenecks, or a policy swerve.

Market liveliness

Indicators like:

- loan volumes,

- interest rates,

- occupancy rates,

- rent levels,

help you detect whether demand is tight or weak, and whether rent growth is plausible.

5) Housing Affordability: A Simple but Powerful Indicator

One especially practical tool is the housing affordability index, popularized in a simple form that compares mortgage payments to household income.

Idea: households can afford a home if the mortgage payment (principal + interest) stays below a chosen share of disposable income, often around 30%.

From your screenshot, the affordability test can be expressed cleanly like this:Affordability Index=0.30−IncomeMortgage Payment(s,T,House Price×LTV)

Interpretation

- If the index is > 0, the household is (by this rule) within the affordability threshold.

- If it’s ≤ 0, the payment burden is at or above the threshold, and affordability is strained.

Where:

- s = interest rate

- T = loan term (duration)

- LTV = loan-to-value (percent of price financed)

This is not “the truth of affordability,” but it’s a high-utility thermometer: fast, intuitive, and comparable across neighborhoods and time.

6) Competition: Don’t Count the Wrong Rivals

A property’s future performance depends not only on demand, but on what else can substitute for it.

A smart competitive scan looks at:

- comparable properties (use, size, age, quality),

- properties near end-of-life that might get refurbished,

- sites that could be developed into competing supply,

- properties whose zoning could change into competing use.

Also: two properties in the same area might not truly compete if their functional efficiency differs dramatically (think outdated warehouses that can’t support modern logistics).

7) The Practical Takeaway: Match Research to Uncertainty

A simple decision rule you can steal:

- Low uncertainty + simple asset: lean research, focus on rent levels, vacancy, NOI-value relationships.

- High uncertainty or complex, flexible-use asset: deeper studies, scenario thinking, better data quality, and explicit competitive forecasting.

- Risk-averse investor: spend more on information to reduce uncertainty (but accept lower margins).

- Risk-tolerant investor: spend less, move faster, accept wider error bars.

- The Real Estate Market (Chapter 1 summary)

This blog post is a summary of Chapter 1 from the book, Real Estate Investing – Market analysis, Valuation Techniques and Risk Management by Benedetto Manganelli.

Real estate sits at a unique intersection of economics, society, and everyday life. Unlike most goods we buy and sell, property satisfies basic human needs while also functioning as a financial asset. This chapter explains why real estate markets behave very differently from “normal” markets, why prices move in cycles, and why valuation is never as simple as multiplying rent by years.

1. What property really represents

For most of history, owning land or a building was central to survival and stability. Property provided shelter, security, and control. Over time, however, lifestyles changed. Today, many people rent their homes, work in offices they don’t own, and treat property less as a necessity and more as a choice.

Despite this shift, buildings still offer a wide range of benefits. Beyond shelter, they provide convenience, social identity, business utility, and financial security. As a result, people buy real estate for two fundamentally different reasons:

- Self-use

The buyer wants to live in the property or use it directly for work or production. The benefit comes from using the space itself. - Investment

The buyer wants income (rent) or wealth growth (price appreciation). The property is treated as a financial asset.

Most households sit somewhere between these two motivations, while professional investors lean almost entirely toward the second.

2. Property as an economic good

A building can behave like:

- a consumer good, when it satisfies personal or social needs, or

- a capital good, when it produces income or supports other production.

Like any economic good, a property’s value rises when demand increases and falls when supply expands. But real estate has characteristics that make this relationship slow, uneven, and often distorted.

3. Why land makes real estate special

Every building combines two elements: land and construction.

Land is scarce. You cannot manufacture more of it, and its availability is tightly controlled by geography and planning rules. At the same time, land is durable. Unlike buildings, it does not physically wear out.

Because of this, land generates rent, which comes in two forms:

- Differential rent: Some land is more valuable due to location, infrastructure, services, or legal permissions.

- Absolute rent: Land earns value simply because it is scarce, regardless of what is built on it.

However, land value is not guaranteed to rise forever. Pollution, economic decline, or changes in lifestyle can make an area less desirable. If land no longer satisfies human needs, it can lose value despite its physical permanence.

4. Immobility and poor convertibility

Once land or a building is assigned a function, changing it is difficult. Converting an industrial site into housing, or outdated offices into residences, is often slow and expensive. Sometimes it requires demolition and rebuilding.

This poor convertibility, combined with physical immobility, makes real estate extremely sensitive to economic and social changes. Buildings cannot move, but demand can.

This is a major reason why real estate markets do not adjust smoothly.

5. Location creates uniqueness

Because properties cannot move, every real estate market is local. Prices are shaped by neighborhood conditions, access to infrastructure, social environment, and economic activity.

A technically sound building can lose value if people move away from the area. At the same time, properties on the outskirts of growing cities can gain value as development moves outward and they become more “central” over time.

This contrast between fixed assets and moving economies makes every property unique and eliminates the possibility of a perfectly competitive market.

6. Regulation is part of the asset

Owning property means owning a set of legal rights:

- to use the land,

- to lease it,

- to sell it,

- to modify it (within limits),

- to use it as collateral.

Planning rules define permitted land uses such as residential, commercial, or industrial. Public land uses like roads, parks, and schools are tightly connected to private land values.

A key idea here is interdependence. The value of a property depends not just on itself, but on what surrounds it and how well it is connected. Infrastructure increases value, but also introduces taxes and long-term costs.

7. The human side of housing

Homes are not purely financial assets. They carry emotional, social, historical, and cultural meaning. For many people, buying a house is as much about identity and security as it is about returns.

This explains why housing markets often behave irrationally compared to other investment markets.

8. Who operates in the real estate market

Real estate involves many participants: builders, developers, lenders, brokers, valuers, managers, investors, and households.

Households are especially important. When families buy homes, they are not acting like pure investors. Their decisions depend on:

- house prices,

- rent levels,

- long-term interest rates,

- lifestyle preferences,

- and emotional factors.

This mixed motivation explains much of the instability seen in housing markets.

9. Rent as cash flow: the DCF logic (and its limits)

A common idea in real estate is that the price of a property should equal the present value of the rent it generates. This logic uses discounted cash flow (DCF).

Demand price (buyer’s perspective)

A buyer may estimate a property’s value as:Pd=t=1∑n(1+Ri)tQa

Where:

- Pd is the price the buyer is willing to pay,

- Qa is expected net annual rent,

- Ri is the long-term interest rate or opportunity cost.

This reflects how attractive the property is compared to alternative investments or borrowing costs.

Supply price (seller’s perspective)

The seller’s minimum acceptable price can be expressed similarly, but discounted at the return they require from capital invested:Po=t=1∑n(1+Rm)tQa

Where:

- Rm represents the marginal efficiency of capital invested in the case of purchase.

When , buyers and sellers are indifferent. When expected returns exceed financing costs, buying becomes attractive. When they don’t, renting may make more sense.

The key warning is this: these calculations express personal convenience, not market value. Market value depends on broadly shared expectations and market-wide discount rates, not individual preferences.

10. Why the real estate market is imperfect

Real estate markets fail the conditions of a perfect market because:

- properties are heterogeneous,

- transactions are infrequent,

- information is incomplete,

- supply adjusts slowly.

Prices are discovered through negotiation, not instant competition. Buyers and sellers search for prices rather than accept them automatically.

This places real estate somewhere between monopolistic competition and oligopoly-like behavior.

11. Segmentation: many markets inside one city

There is no single real estate market. Instead, there are many submarkets, defined by:

- location,

- use (residential, commercial, industrial),

- building type and quality,

- tenure (sale vs rent).

Properties belong to the same segment when buyers consider them substitutes. When price changes in one area spill over into another, those areas are part of the same submarket.

12. Short run vs long run dynamics

In the short term, new construction is minimal and supply is rigid. Prices and transactions are driven mostly by demand.

In the long term, construction, redevelopment, and demolition reshape supply. But because development takes years, supply almost always reacts late.

This delay is the foundation of real estate cycles.

13. Real estate cycles explained

Real estate markets move through recurring phases:

- Early recovery

Prices are stable, transactions increase. - Expansion

Prices rise, profits attract investors, new construction begins, optimism grows. - Peak and slowdown

Supply is high, demand weakens, risk increases. - Decline

Prices fall sharply, buyers wait, excess supply clears.

Because information is imperfect and construction takes time, these cycles repeat.

14. Sales market vs rental market

The sales market trades ownership. The rental market trades use.

Investors connect the two: they buy in the sales market and supply housing services in the rental market. Rental markets adjust through changes in rent levels and vacancy rates, giving them more short-term flexibility than sales markets.

Although closely linked, prices and rents do not always move together due to regulation, financing constraints, and transaction costs.

15. Price-to-rent ratios and bubbles

One common way to detect housing bubbles is by comparing prices to rents. Since rent represents the “income” from housing, a price-to-rent ratio far above historical norms can signal overvaluation.

However, this measure must be used cautiously. Structural differences between rental and sales markets can cause long-lasting divergence without true mispricing.

Final takeaway

Real estate markets are local, segmented, imperfect, and cyclical. Demand moves faster than supply, information travels slowly, and prices are shaped as much by human behavior as by economics.

At the core of valuation lies a simple idea: property value reflects expected future benefits discounted over time. But in real estate, the choice of discount rate, the rigidity of supply, and the psychology of buyers ensure that markets rarely settle neatly into equilibrium.

- Self-use

- Beginner’s guide to Freelancing/Entrepreneurship

This essay was originally written for a lecture given to first year BBA students at Sant Hirdaram Institute of Management, Bhopal on 7th August, 2025. Link to the recording of the lecture is given at the end of the essay.

Intro

This essay will teach you how to establish yourself as a freelancer and earn good money. This will perhaps not make you a millionaire but it will get you started. You will have enough clients that you wouldn’t have to worry about your next paycheck. And the best part is, this can be done in parallel to your day job.

Pick a niche Step -1: Pick a niche. It could be anything, sports, cooking, agriculture, mathematics, coding etc. Wherever you have technical expertise. Make sure not to pick marketing, there is cut-throat competition there. And you will be competing agencies and teams there. (If you really think you are a good marketer, maybe build a business first, then talk about marketing.)

The aim here is to find the minimum viable audience. MVA is your 1000 true fans, that you can sell your products and services to. You should delight these people with your marketing communications.

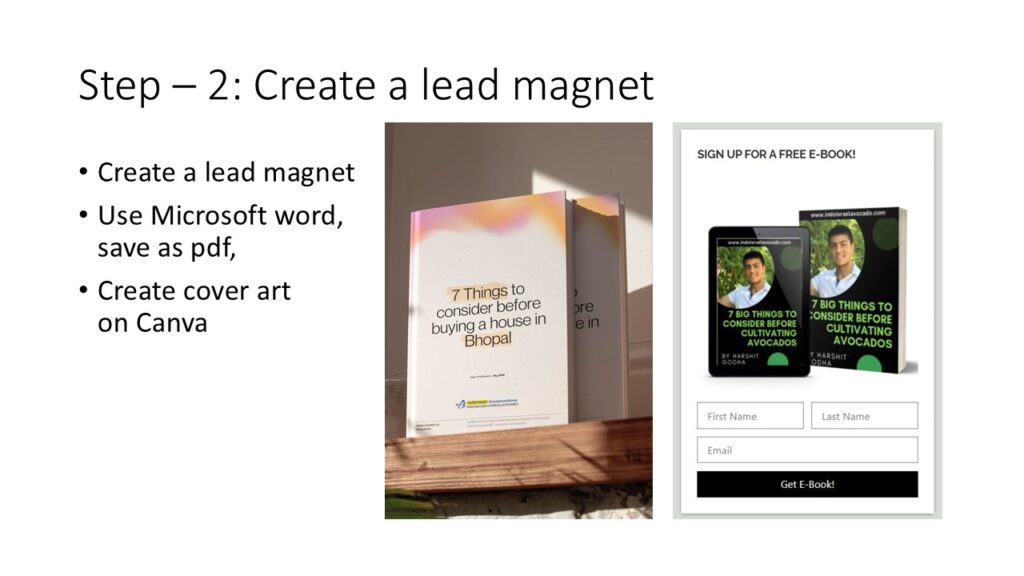

Create a lead magnet Step-2: Create a lead magnet. A lead magnet is an info product, usually an e-book but can be a video or audio, excel sheet or some other form of content that is exchanged with a person in return for their emails.

These should be easy to create if you already have domain expertise in your niche. But, for the love of God, do NOT simply copy & paste from Chat GPT. Everyone can do that, create something that’s not on Chat GPT.I have created 2 lead magnets so far –

- one is for my avocado business, which has over 9000 downloads. I did not use any performance marketing to get those leads.

- second one was for my family business which has around 250 downloads within a span of 15-20 days.

I created these using Microsoft word and saved them as pdf, created cover art on Canva and hosted it on Mailchimp.

More examples of a lead magnet –

Barbarian days: A surfing life The next two examples I am going to share are by people I actually follow. Ludwig’s work is worth reading and I have also bought his investing course that he has created together with Mikael Syding, but haven’t gotten around to actually building my portfolio, yet. And if you are an aging athlete who wants to take it to the next level in your fitness journey despite being in your 30s or 40s, but are too scared of taking steroids, peptides might be the answer for you. And there is no one better than Jay Campbell to learn from, about anti-aging peptides and hormone optimization therapy.

Start Gaining Momentum

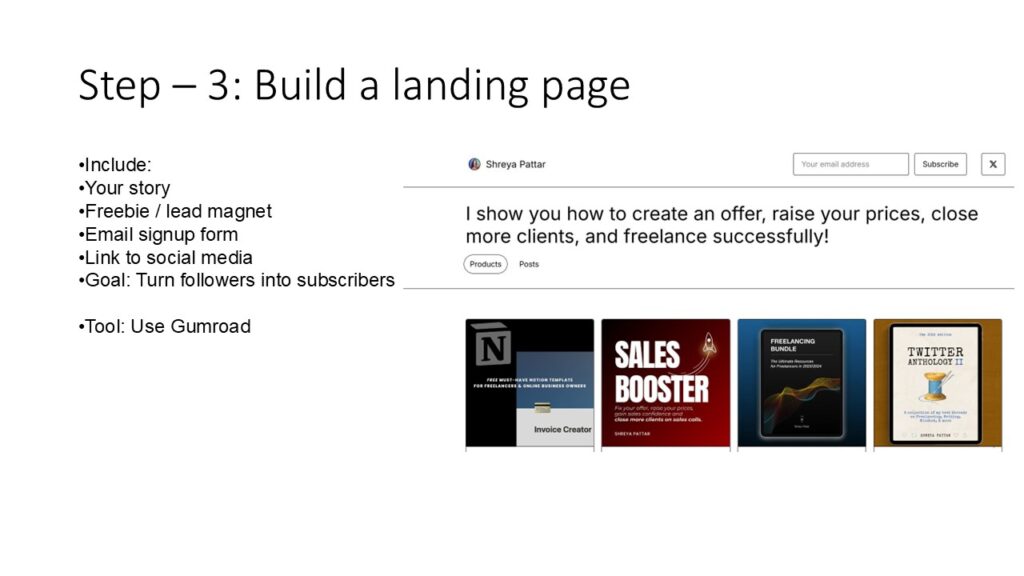

Shreya Pattar, The LinkedIn Alchemist Step – 3: Build a landing page. Once you have the lead magnet, publish it on Gumroad or make a Mailchimp landing page. It should include a bit about your background, an email sign up form and obviously your lead magnet. The example I have shared above is also a person I follow. Shreya is great at making you famous on Linkedin. It appears, that she is living the life, remotely working from a laptop, earning in dollars and living in Dubai. Who doesn’t want that.

It’s a funnel, lol Step – 4: Publish content on social media. This is where it gets interesting. Most

retardspeople start publishing on Instagram with no aim or clear goal in mind. They hope that one viral video will make them famous and then they will get picked or head hunted by someone and only after that, their life will be sorted. WRONG.Your goal with your social media is awareness. However, that hardly gets any sales. Sales come from engagement. Your aim should be to convert your aware followers into paying subscribers. I will cover that in the next step.

How to create awareness on social media?

- Document your journey, publish content daily. Give your followers a a Window to your world through your earned media channels.

- Pick 2 platforms to start with, Instagram is surely one of them, for now.

- Master the written word, audio or video,

- It helps if you are jacked and handsome (of course, I am talking about myself) or

- It also helps if you are a pretty woman (if you are a woman reading this, don’t put soft porn out on Instagram, show the world that you are an elegant beauty with brains).

- Learn story telling, it will come with practice.

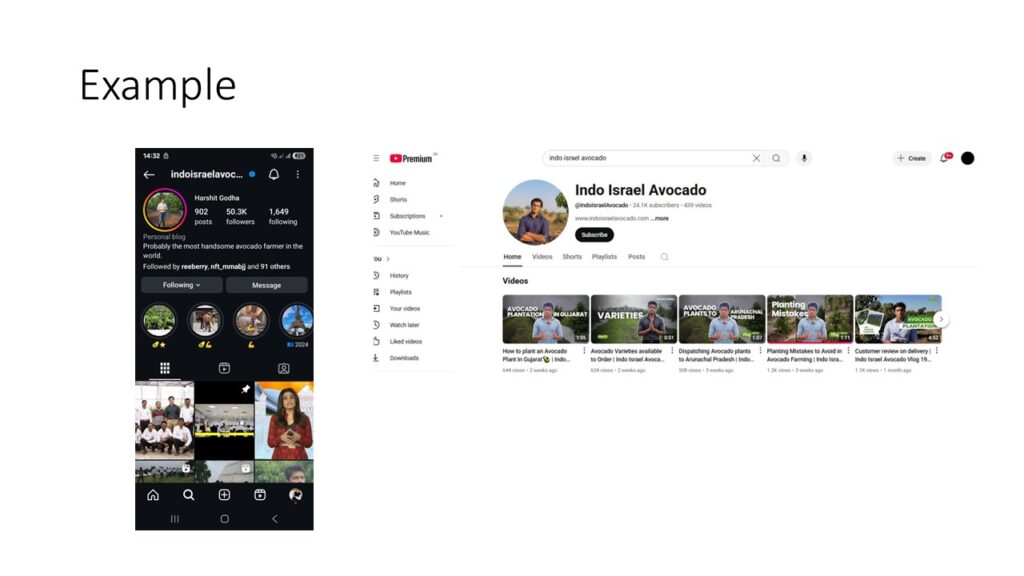

The Most Handsome Avocado Farmer in the World.

I have 11 identities, and all of them are bi-polar 😉

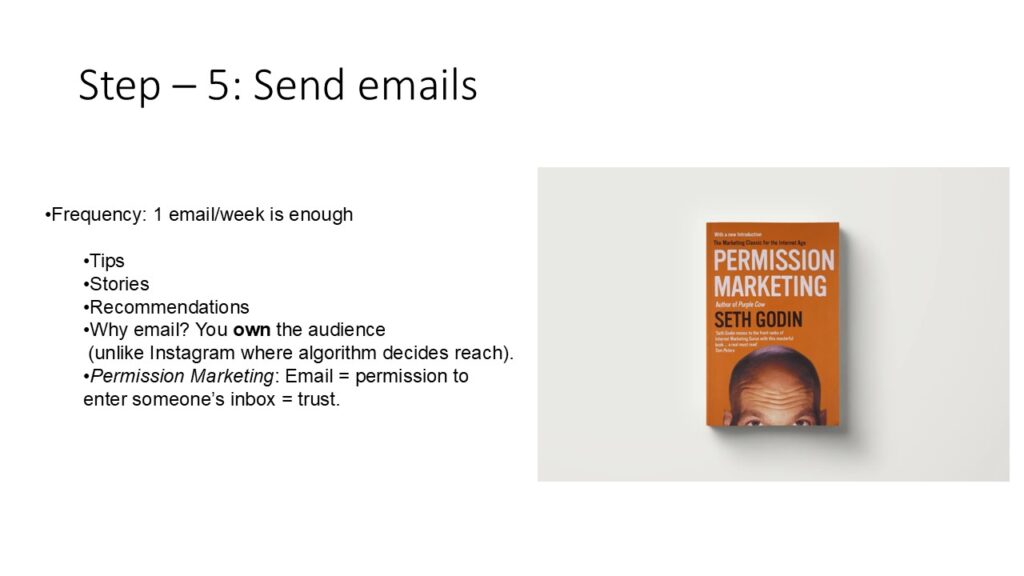

Permission granted Step – 5: Send emails. You publish content on social media for awareness. You write emails for engagement. Your true fans will read them. You only have to sell to them. You have to share things that truly adds value to their lives.

Your Gen – Z marketing buddy will tell you, like the little retard that he is, that email is dead.

Platforms come and go (remember facebook? or orkut? or myspace?), email is forever, and guess what, you can create look-alike audiences on meta from that email list.

You own the audience on email, unlike Instagram where the meta overlords decide your reach. That book recommendation is there for a reason. Read it.

Teach First Step – 6: Sell digital products or courses. Put some content behind a pay-wall and teach what you know. In scientific terms, convert tacit knowledge to procedural knowledge and charge money for it.

Indo Israel Fertigation Course Step – 7: Collaborate. The lone wolf dies, but the pack survives. Collaborate with others and share the profits reasonably equally. This won’t be your first course or content behind a pay wall.

And the best part is, bringing in experts from other fields will fill the gaps in your research.

Bonus tip

Address, apologize & move on We all start somewhere. Cringe is okay. Inconsistent effort is not.

Quick recap And remember,

Perceptions change easily,

Attitudes, not so much,

but Values never change.Good luck.

Harshit Godha

The recording of the lecture –

Beginners guide to Freelancing/Entrepreneurship – Harshit Godha - My first amateur MMA fight

I had started training MMA in Feb 2025. I always thought my first fight would be in Thailand after training for Muay Thai for 6-8 months. But life gets in the way and our plans might not get executed as we expect them to be. Earlier the ICL tournament was supposed to happen on 25th April, but then it got postponed to 16-18th may. I had booked VIP package for the Guns n Roses concert which was supposed to happen on the same dates. I couldn’t miss either. So I asked the organizing committee to schedule mine for 18th. They agreed on call but I needed written confirmation, so I got it on WhatsApp. I wasn’t nervous during my training initially. But as the competition approached I could feel the anxiety crawling in.

The three moves I knew were, clinching, hip thrust and American arm lock. I knew I was getting into something serious, something I hadn’t done before. During training and sparring, I knew I will be safe. However, sparring is different from fighting, during sparring we try to prolong the game, there is no urgency to finish the fight. But during fight, decisions were supposed to be made within split seconds and there is a sense of urgency to finish the fight.

My team had gone on the scheduled dates for weighing in. I did mine online. As I went for the concert in Mumbai. There were 5 songs which I wanted to listen, Sweet Child o Mine, Welcome to The Jungle, Paradise City, November rain and Knocking on Heaven’s door. I reached the venue, Mahalaxmi race course, I went solo, time to time I need a solo trip clear my head. I was actually excited that I would first go the concert gather some motivation and go to the fight with my head buzzing with Rock n Roll. I needed something to stop thinking about the fight. To interrupt the pattern in my thinking.

Luckily Axl Rose was not late this time, and the concert started on time with welcome to the jungle. I had a cocktail in hand and cigarettes in my pocket. It rained earlier that day and the vip section was muddy. That didn’t stop me from getting my feet dirty to stand right in front of the stage. Seeing Slash and Axl Rose on stage from a 40 ft distance was thrilling. I was in the zone and wasn’t thinking about the fight. It lifted my spirits atleast for the time being. I also wanted to meet people there, but no opportunity presented itself for me to approach.

Welcome to the Jungle I wanted to numb myself with alcohol and cigarettes’ and enjoy the show. Which I did even though my brain was saying it was a mistake to smoke and drink right now. The songs were slightly different from the versions that I listen to on Spotify. The studio version is crisp whereas the live was depended on the crowd. Also Axl had put on weight but I can cut him some slack, he was getting older. Slash still looked muscular.

There were two more guitarists, 2 on keys and a very energetic drummer. The drumming was on point. Towards the end of the concert, I thought I could leave early and get back to my cousins place in time. I tried asking about the shuttle service to go outside but the organizing team didn’t know. So I went to the smoking area. I had probably only finished half of my cigarette and I could hear the roar of the crowd and and a familiar tune. This was paradise city. I threw my Cigarette in the trash can and ran back into the front to see the last song. I didn’t record all of the songs. I asked a guy standing right behind me to send me his recordings. I took his phone no. but he never sent me the videos. But its okay. I wanted to enjoy the concert. And I knew if I ever wanted to find the videos of the live concert, it would be available on the internet.

As I finished the concert and some how found the shuttle to the exit, paid 5000 for the black and yellow cab to take me back to sister’s place. I reached my sisters place and tried sleeping for a few hours as I had to reach the airport at around 4 am. I couldn’t sleep. Shit was about to get real very soon.

At some point during the concert I got a video of my friend Zoravar breaking the the nose of his opponent. I was just hoping that Ajay wouldn’t break mine. I had a trip planned with my girl friend afterwards so I had to reach the airport next morning in one piece to pick her up.I was early for my flight, I was relieved that I had reached the airport and did the security check in in time. However, my gate had two entries A and B. My flight was from the B gate and I was sitting near Gate A and I didn’t realize it until I heard the announcement for the final call. My heartbeat raced, and I quickly stood up to queue, there was none, all the passengers had boarded the flight. As I boarded, I was informed that my seat had been upgraded from economy to premium economy. I tried sleeping in flight but couldn’t. As I landed, I asked Farm Boys MMA team what time their team member Ajay would come, they said 1. I had time so I went to my father’s friend’s house. Had break fast, smoked my last cigarette, and tried to take a nap for 1 hour. Again, no sleep.

Then I went to the venue, Talkatora stadium. My team and my opponent’s team wasn’t there yet. While I was there, I didn’t see anyone get injured and there were young boys fighting, Watching those 14 year olds fight, gave me strength and courage. I thought to myself it wouldn’t be that bad. My team had arrived and that gave me confidence a boost. They were there for me, I wasn’t alone. Soon Farm Boys MMA team arrived, and my team mates went to the organizing committee to arrange my fight.

All welter weight fights were supposed to happen on 17, but I requested mine for 18th. Suddenly they announced my name, I thought I had more time and fight would be conducted in the evening but shit just got real, and I quickly changed and got ready for the fight. I briefly bumped into Ajay and we nodded and said hello to each other. He was wearing a loose shirt. I thought this guy is a boxing coach and he is not fit. Maybe I have shot at winning. At that moment, he took his shirt off and I thought to myself, I am fucked. He packed serious muscle, same weight as me but a little shorter height means more muscle mass which equates to more strength. We entered the cage.

I can’t recall the fight accurately but I have a video, I will watch it now and try to understand what decisions I made during the fight and why.

I remember I was completely zoned in, I had felt this before mostly when I used to approach women or when I had to give exams. The refree briefs us with the rules, I didn’t know what I would do in the beginning, I had no plan of action or strategy, I try to hit him with a few punches, they land no where, I was trying to get points, then I got hit with 3 punches, I couldn’t block nor did I saw em coming, even now while watching this on video while drinking Kingfisher Ultra, I did not see em coming, so what this tells us, when you are in a fight, whoever takes the first move, should expect a counter move from the opponent and prepare accordingly.

Wasted Years He punched me a few more times, and I land a punch on the side with the help of some momentum. I don’t think it would have done anything. Then I heard someone say Harshit clinch, I knew my coach Nitish had said, if he is a boxer, you have to do grappling, seedhe clinch karlena, and I remember from the practice that you could take a fake shot and go into your planned move, so I attempted a fake shot clinched him, but I think my eyes were closed, because I don’t recall planning to get his arm in the clinch, I don’t know if this was an advantageous move in Brazilian Jiu Jitsu or not, but at the time of the fight, I thought I am in an advantageous move, I have got his hand, but on a second thought, now I think it is not an advantageous position, he has more control over me that way, but I also have some control over his arm movements.

At that point I gave up, I knew I could only stop him 10-15 seconds, before he plans his next move, because I had no plan of action, someone was saying niche, take him down, but I didn’t know how, I mustered up a lot of courage for the clinch, and I ran out of gas, I knew he would take me down and the only thing I could do was prolong the duration of the fight, I hit him with a few punches on his face, but there was no torque because I was at the bottom, then he hit me with two punches one from each hand, then another punch and I grab him by the neck and got him into guillotine, but he easily released himself from it, then I got hit with two punches, and I think one landed on my nose, at that point I could see blood, and I recalled my father saying, stop when it gets too extreme, you have only trained for a few months, and your opponents will be experienced, I tapped out, then he hit me with two more after tapping out, fucker, bhai hoo gay ana, tap kar toh diya, fir kyon mar raha hai.

This is where the video ends.

Be quick or be dead I have tried to recall the reasoning of my moves to the best of my ability, what I am trying to do is create a fighting strategy for myself. Understand what specific moves I will make and in which order if I am in a situation where I have to fight.

I recall getting surrounded by people, I was not in the position to understand who was who, but I recall Abhishek’s voice saying, agar kuch toota hota toh abhi kuch bol nai rahe hote, that gave me reassurance that nothing serious had happened, I am alive and I can go on a trip with my girlfriend, and I was feeling very relaxed after the fight, I had faced my fears head on. And I survived.

They took me into the medical corner and they checked and everything was fine. I was not nervous anymore, I felt relaxed and a sense of accomplishment I haven’t felt in a long time.

In retrospect, I think I gambled and played a high risk move, I had a vacation planned with my girl friend and I had to reach the airport to pick her up in one piece. Had I ended up in a hospital, my trip would have been ruined.

I think that day I earned street cred from my team. Then we collected our medals and certificates, I dropped Anurag at the train station and I went to my aunt’s place.Few learnings

He landed 2 punches on my face even after I tapped out, I think, and I can only guess right now, that he was teaching me something, don’t be afraid to hurt someone physically. When the situations demand, you have to attack, hard.

I think I will continue training for self defense. I know I will start with BJJ, and then add Muay Thai, Russian Sambo and Krav Maga in a few years time. I know if I train for 10 years I will be good enough.

Another thing that I realized was, and I draw inspiration from my school’s teaching style, if I give tests often, then when the final exam happens I will be good and prepared. The more often I compete, the more I learn.

I also realized that I learn more in fights than I learn in sparring. If I keep competing, sooner or later I will find a winning strategy. My gut feeling says there are a combination of few moves, that can take me further as opposed to mastering every technique.

My opponent Ajay was a nice guy. He said two things to me that I will remember,

1. You have got the heart for it, and

2. He mentioned his coach said to him, don’t go easy on your students even if they are noobs.

Here is a video of the fight if you would like to watch –

For Whom the Bell Tolls Walk with me in Hell Thanks for reading.

-Harshit

- 22 Steps to get in shape by 2034

Step 1: Join a gym and start doing a bro split and eat 6 meals a day. Do this for 2 years and have very little to show for it.

Step 2: Start running 10 Kms. Lose some body weight but have no muscle mass what so ever.

Step 3: Run a half marathon. Do a sprint finish. Barely walk for 2 days but make sure to wear the finisher t shirt the next day to show every one that you finished a half marathon.

Step 4: Accidently stumble upon skinnyfattransformation.com. Realize you need to seriously change your dietary habits and lose more weight to the point you look anorexic.

Step 5: Lose a lot of weight by practically starving yourself and do push ups and pull ups. Ignore legs even though you have knock knees.

Step 6: Hire Oskar from Skinny fat transformation.

Step 7: Build some muscle mass and gain the ability to do 15 pull ups. Start training heavily at the gym and increase fat intake. Start doing legs some times.

Step 8: Finally be lean with a 4 pack but still get frustrated by love handles, gynecomastia and large areolas.

Step 9: Get love handles liposuction and gynecomastia surgery. Wait for 6 months to see the results.

Step 10: Still stay frustrated with the results because your choice of surgeon was wrong.

Step 11: Keep going to the gym, make it your priority and completely ignore work. Get obsessed with nutrition.

Step 12: Have an accident, lose all your strength, get mentally unstable, hop on anti psychotics.

Step 13: Get gynecomastia again because of increased prolactin from Risperidone and Divalproex, have issue with confidence and self esteem, and struggle with performance in bed.

Step 14: Start a bulk and make sure to grow your hair while at it to look dangerous even though you are not dangerous yet.

Step 15: Gain the ability to do 40kg weighted pull ups, 50kg x 2 db incline bench press, and 40kg weighted dips.

Step 16: Get fat while bulking. Lose the motivation to workout. Do the bare minimum to keep the flame alive while you deal with your personal issues.

Step 17: Decide you want to be lean again as you cant afford peptides yet to look shredded.

Step 18: Get gynecomastia surgery again along with love handles and lower belly liposuction, lose 3 kgs with the surgery.

Step 19: Recover for 1 month, jump on keto carnivore diet. Lose further 7 kgs in 2 more months.

Step 20: Get lean and small again.

Step 21: Get satisfied with the results from the surgery. Start eating some carbs again and gain some % of the previous strength back.

Step 22: Get in decent shape, hire a personal trainer, take cabergoline to reduce prolactin and decide go under the knife again and get areola resized.

Thank me later.

Harshit Godha